ads

Accessing high-value loans without collateral in Kenya has traditionally been impossible through conventional banking channels.

However, the digital lending revolution has introduced mobile apps capable of disbursing substantial amounts up to 500,000 KSh and beyond, all without requiring physical security.

These five apps have transformed high-value lending through alternative credit assessment methods.

Simulate Your Loan Now

💰 High-Limit Loan Comparator

Enter your loan details and instantly compare Kenya’s top high-limit options.

App #1: Equity Eazzy Loan – The High-Value Champion

Equity Eazzy Loan leads Kenya’s high-limit mobile lending market, offering unsecured loans up to an impressive 3 million KSh through advanced digital banking technology.

ads

Why Equity Offers the Highest Limits:

• Banking Infrastructure: Leverages Equity Bank’s extensive financial resources and customer data

• Relationship-Based Lending: Uses comprehensive banking history and account behavior for assessment

• Digital Innovation: Advanced mobile banking platform with sophisticated risk management

• Customer Segmentation: Tiered loan products from standard Eazzy to premium Eazzy Plus

• Regulatory Compliance: Full banking license ensures stability and customer protection

ads

Market-Leading Products:

• Eazzy Loan Standard: Up to KSh 200,000 for 30-day terms with instant mobile access

• Eazzy Plus Loan: Up to KSh 3,000,000 with flexible repayment periods up to 24 months

• Instant Processing: Application to disbursement within minutes via Eazzy app or *247#

• Competitive Rates: 2% to 10% monthly interest based on creditworthiness and relationship

• Multiple Access: Available through Equitel line, mobile app, or USSD banking

Maximizing Your Limits:

• Maintain active Equity Bank account for minimum 6 months before applying

• Channel all income and salary through Equity account to demonstrate capacity

• Use Eazzy banking app regularly to build digital engagement history

• Start with smaller Eazzy loans to establish repayment behavior before applying for Plus

• Consider Equitel line for enhanced banking services and preferential treatment

Find out Below Which Loan is Best For You

💰 Find Your Perfect High-Limit Loan App!

Answer 4 quick questions to find the best app for your borrowing needs.

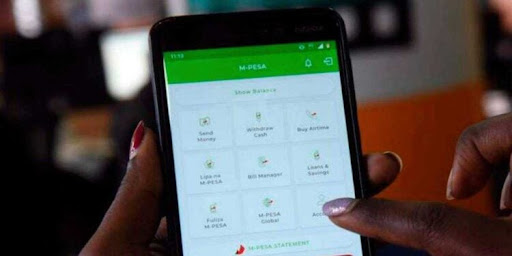

App #2: KCB M-Pesa – The Mobile Money Giant

KCB M-Pesa combines Kenya’s largest bank with the country’s dominant mobile money platform, offering unsecured loans up to 1 million KSh based on transaction history.

M-Pesa Integration Advantages:

• Transaction Analysis: Uses comprehensive M-Pesa history for instant credit decisions

• Bank Partnership: Leverages KCB Bank’s resources and Safaricom’s mobile money data

• 24/7 Availability: Loan processing available round-the-clock through mobile platform

• Progressive Scaling: Limits grow from KSh 50 to 1 million based on usage patterns

• Seamless Experience: Direct integration with M-Pesa for disbursement and repayment

High-Limit Solutions:

• KCB M-Pesa Loans: Up to KSh 1,000,000 for qualified users with extensive transaction history

• Competitive Rates: 7.35% to 8.9% monthly with transparent fee structure

• Instant Approval: Real-time processing using automated M-Pesa data analysis

• Flexible Access: Available through M-Pesa menu, KCB app, or SIM toolkit

• No Documentation: Phone number and M-Pesa PIN are the only requirements

Limit Growth Strategies:

• Maintain active M-Pesa usage with regular high-value transactions for 12+ months

• Use various M-Pesa services including savings, bill payments, and business transactions

• Ensure consistent monthly transaction volumes to demonstrate financial stability

• Start with smaller loans and repay promptly to unlock million-shilling limits

• Consider opening KCB bank account for enhanced relationship benefits

App #3: M-Shwari – The Safaricom Financial Ecosystem

M-Shwari leverages Safaricom’s comprehensive customer data and NCBA Bank’s financial expertise to offer loans up to 1 million KSh without traditional collateral requirements.

Ecosystem Integration Benefits:

• Safaricom Data: Uses complete mobile usage patterns including airtime, data, and service history

• Banking Partnership: NCBA Bank provides financial infrastructure and regulatory compliance

• Customer Profiling: Long-term Safaricom relationships enable higher risk tolerance

• Integrated Services: Combines savings, loans, and mobile money in single platform

• Market Penetration: Serves millions of Kenyans through familiar M-Pesa interface

Comprehensive Financial Products:

• M-Shwari Loans: Up to KSh 1,000,000 for established customers with excellent payment history

• Savings Integration: Earn interest while building loan eligibility through M-Shwari savings

• Flexible Terms: 30-day standard terms with automatic renewal options for qualified users

• Transparent Pricing: 9% annual interest, 7.5% one-time fee, plus 1.5% excise duty

• Universal Access: Available to all Safaricom customers through *234# or M-Pesa menu

Success Optimization:

• Maintain Safaricom services for extended periods to build comprehensive customer profile

• Use M-Shwari savings consistently to demonstrate financial discipline

• Keep active M-Pesa account with regular deposits and transaction activity

• Repay all M-Shwari loans promptly to unlock progressive limit increases

• Consider Fuliza overdraft service to enhance overall Safaricom financial relationship

App #4: Okash – The AI-Powered Lender

Okash utilizes artificial intelligence and machine learning to assess creditworthiness, enabling unsecured loans up to 500,000 KSh for qualified borrowers with consistent repayment behavior.

Artificial Intelligence Advantages:

• AI Technology: Advanced algorithms analyze smartphone data and behavioral patterns

• Opera Group Backing: International technology expertise with local market knowledge

• Facial Recognition: Enhanced security through biometric verification and identity authentication

• Learning Algorithms: System continuously improves credit assessment accuracy

• Quick Processing: AI-powered decisions delivered within seconds of application

Technology-Driven Products:

• Okash Loans: Up to KSh 500,000 for established users with excellent repayment history

• Smart Scaling: Starts at KSh 1,500 for new users, growing to maximum limits over time

• Flexible Terms: Up to 24 hours for immediate needs, extending to longer periods for qualified users

• Low Interest Options: As low as 1% daily for short-term loans with quick repayment

• M-Pesa Integration: Seamless disbursement and repayment through mobile money

AI Optimization Techniques:

• Provide comprehensive and accurate personal information during registration

• Use smartphone consistently for various activities to generate positive behavioral data

• Maintain stable contact lists and social connections for algorithm analysis

• Repay all loans promptly to demonstrate reliability to AI learning systems

• Engage with app regularly to show continued interest and financial responsibility

App #5: MCo-op Cash – The Cooperative Banking Solution

MCo-op Cash leverages Co-operative Bank’s extensive SACCO network and cooperative banking expertise to offer loans up to 500,000 KSh without traditional collateral requirements.

Cooperative Banking Strengths:

• SACCO Integration: Extensive network of cooperative societies enhances credit assessment

• Salary-Based Lending: Up to 2 times net salary for qualified employees

• Universal Access: Available to both Co-op Bank customers and non-customers

• Digital Platform: Modern mobile app and USSD access through *667#

• Flexible Qualification: Multiple pathways to meet lending criteria

Inclusive High-Value Products:

• MCo-op Cash Loans: Up to KSh 500,000 based on salary multiples or creditworthiness

• Salary Loan: 1.5 to 2 times monthly net salary for account holders

• Instant Processing: Application to disbursement within minutes via mobile platform

• Competitive Fees: 8% to 12% depending on loan term, plus insurance and excise duty

• Flexible Terms: 1 to 3 months with upfront fee deduction

Qualification Enhancement:

• Open Co-operative Bank account and channel salary for enhanced limits

• Join SACCO affiliated with Co-operative Bank for preferential treatment

• Use MCo-op Cash regularly for smaller amounts to build credit history

• Maintain consistent income patterns to qualify for salary-based calculations

• Consider business banking with Co-op Bank for commercial lending opportunities

High-Limit Loan Comparison

| App | Maximum Limit | Key Advantage |

|---|---|---|

| Equity Eazzy Loan | 3,000,000 KSh | Banking infrastructure & relationship lending |

| KCB M-Pesa | 1,000,000 KSh | M-Pesa integration & 24/7 availability |

| M-Shwari | 1,000,000 KSh | Safaricom ecosystem & universal access |

| Okash | 500,000 KSh | AI technology & behavioral analysis |

| MCo-op Cash | 500,000 KSh | Cooperative network & salary-based lending |

Conclusion

These five apps—Equity Eazzy Loan, KCB M-Pesa, M-Shwari, Okash, and MCo-op Cash—have revolutionized high-value lending in Kenya by making substantial unsecured loans accessible through mobile technology.

Success in accessing their highest limits requires building strong financial relationships and demonstrating consistent repayment behavior.

While reaching maximum limits takes time and discipline, these platforms offer unprecedented opportunities for qualified Kenyans to access significant funding without traditional collateral requirements.